Why you should think about getting flood insurance

PLYMOUTH, IND --- The cleanup from last week’s record flooding is just beginning.

As many rip-out waterlogged material from homes and businesses, people are now worried about how they'll pay for repairs. Many did not have flood insurance because they didn’t live in a floodplain.

“This community has never seen a flood like this,” said Nichole Hickey, a Plymouth mother of five.

“I know a lot of people are angry about it and to be told that we are not in a floodplain and 0.2% and it will never flood and then this.”

Nichole and her family have already been through one disaster in the past year: a house fire.

“We were both at work when it happened. It was June 28th,” she said. ”I pulled up to our house completely in flames.”

Now she has to deal with historic floods ruining her newly rehabbed home.

ABC 57 visited the flood zone Monday, just a day after flood waters finally trickled out of her Plymouth neighborhood.

The stairs to the home were washed away against a tree, and a damp smell filled the air inside her home.

“As you can see by the sides of the doors and the walls it did get up pretty high,” Hickey said as she gave us the tour. “It got a lot higher over here. You can see the staining of the door. This room--the whole floor is just shot, and it's just bubbled and completely destroyed.”

The goal after the fire was to fix it up and get it on the market. Hickey and her husband Josh just wanted to pay off their mortgage and move on. The family of seven knew they were outgrowing their 1,400-square foot house.

The modest home is fit for any starter family and is within eyesight of the yellow river. They were required by the bank to have flood insurance when they first bought the house.

Hickey explained that she paid for flood insurance for years and that she never thought twice about it because she lived so close to the river.

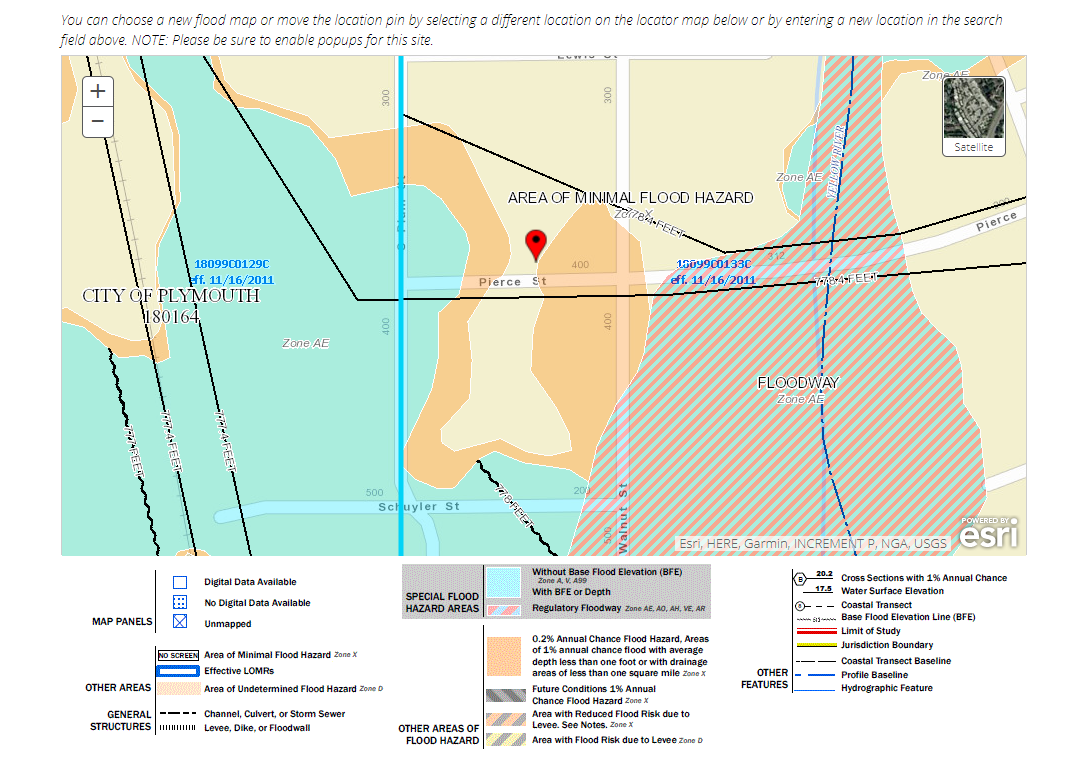

This house is less than two blocks from the river and most of her neighborhood is no longer in the floodplain. After recent rezoning in 2011, the Hickey's house and much of the neighborhood south of Lake Avenue is zoned to have less than a 0.2% annual chance of flooding.

Put your address in the FEMA Flood Map Here

We reached out to the Federal Emergency Management Administration (FEMA) to explain that percentage point.

"That 0.2% annual chance flood--those are areas where there is a lower risk, but a risk that still needs to be delineated on the flood maps," said Mark Peterson, Director of External Affairs with FEMA Region V.

That point two statistic might work fine on paper when insurance companies and banks crunch the numbers, but it doesn’t hold up for the Hickeys.

“Honestly we found out through a letter in the mail, the bank sent us a letter saying they re-zoned and we no longer in the floodplain so they took us off our flood insurance,” Hickey said.

Lenders and insurance companies try to lower premiums for customers, so when they tell them don’t ‘need’ flood insurance, there’s often a misunderstanding. What they are really saying is they are not legally ‘required’ to have it.

According to FEMA, flood insurance, isn't just reserved for those living in high-risk areas. Anyone in Michiana can get flood insurance. In fact, FEMA recommends it.

"It's so important to remember that floods do not end on a line on the map. Floods can extend into areas that have never flooded before in the past," Peterson explained. "Purchasing insurance is the best way to protect yourself financially from those effects."

The Hickeys didn't know they could have been covered during this disaster. Now they’re forced to wait for what comes next.

“We're hoping and praying we have some sort of federal assistance,” Hickey said with a little worry in her voice.

The lesson here: don't let anyone tell you that you don’t need flood insurance. Anyone can get it.

You may not be 'required' to have it, but you need to evaluate your home, whether you have a mortgage or you own it outright, even if live outside a floodplain.

We learned in 2016 that flash flooding--not just river flooding--can cause major damage and not be covered by regular insurance.

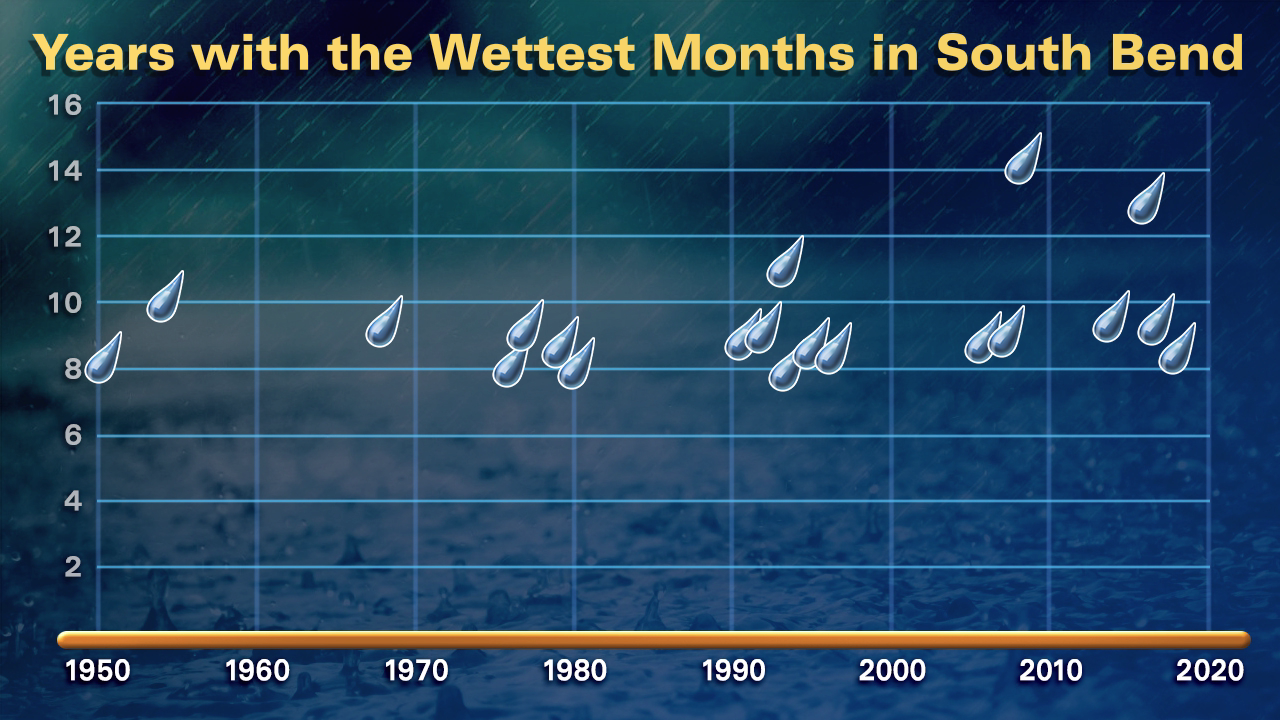

The flood risk keeps increasing locally. The number record monthly record rain events since 1950, over 25% have come since the year 2000 and over 50% have come since 1990. This trend looks to be another added cost of climate change.